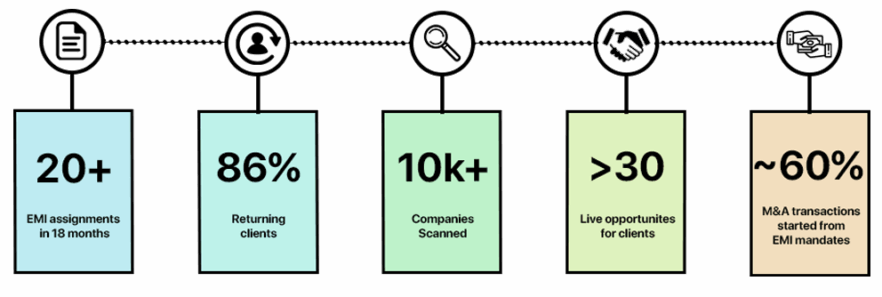

We have extensive experience working with large-scale corporates as well as dedicated entrepreneurs on strategic advisory mandates, helping them navigate complex strategic challenges.

We provide tailored advice, strategic and market insights, and end-to-end support to enable you to achieve your business objectives.

Our services include:

- Board advisory

- Review of strategic alternatives

- Activism defence/ investor matters

- ESG strategic and capital markets review

- Business plan modelling

- Independent valuations & scenario analysis

- Market sizing and competitor landscape

- Assistance in post-merger integration